Luxury travel is on the rise, as are luxury travel budgets. And for 2022 and beyond, luxury travelers are expected to continue traveling despite economic headwinds and geopolitical instability. At least those are the findings of a recent survey that targeted affluent and wealthy neighborhoods around the U.S.

The survey was fielded in late June by Strategic Vision and the Affluent Consumer Research Company, inviting those with incomes $250K and up, ages 25 to 74. And the findings were positive for the travel industry: Despite economic headwinds and geopolitical instability, luxury travelers are still very keen to travel — 65% of them describe themselves as “excited” about international leisure trips. And while geopolitical issues (such as the Ukraine war) are the most worrisome overall, with one in six expressing “extreme concern,” the Gen X and Baby Boomer affluent (45+) are more concerned about the economy, while the Millennial set (25-44) say that personal safety, including COVID and violent crime, weighs more heavily.

The Demand For Luxury Travel on the Rise

Luxury travel budgets are burgeoning: 52% of affluent U.S. consumers say budgets are higher than before the pandemic and compared to the previous year (42%). Intention to travel remains around the same as it was last year, with 98% saying they have plans to travel within the next 18 months (vs. 98% last year). Last year’s predictions are being outpaced by actual demand; for example, in 2021, 30% of respondents said they planned an international trip for the summer 2022. Now, in 2022, 42% are saying they plan to go abroad this summer. That points to sustained demand for luxury trips.

The Take: Luxury travel will rebound sooner and with greater intensity than the overall U.S. traveler market. As you budget for 2023 and beyond, expect steady demand from this recession-resistant market. Prioritize resolving challenges with staffing and delivering on service because you’ll continue to be busy.

Travelers are Spreading Their Wings

Domestic trips remain far and away the most popular, with 98% of respondents saying they’re planning trips within the Lower 48 in the next 18 months — the same number as last year. North America as a whole, including Mexico and the Caribbean, remains strong. Europe gained, with 54% planning a trip, vs. 43% last year. Asia got a huge bump (34%, up from 18%), as Southeast Asia reopens and travelers look ahead to China doing the same. Interest in Egypt and safaris pushed Africa up from 13% to an astonishing 25%.

The Takeaway: With one out of four luxury travelers planning to visit Africa by the end of 2023, all regions need to brace themselves for a surge. As more distant shores beckon, we can expect demand for the U.S., Mexico, and the Caribbean to begin flattening out but remain robust, given the instable conditions of the economy and COVID.

Getting the Basics Right

When it comes to travel, people want old-fashioned comfort, familiarity, and reassurance, and they’re gravitating towards brands they feel confident can provide that — and away from more lifestyle-driven, trend-led alternatives. In the survey, 76% of travelers indicated plans to stay with hotel brands with iconic, heritage properties, including Four Seasons, Ritz-Carlton, InterContinental, Fairmont, Rosewood, and others. Privacy, of course, never goes out of style, and private jets remain a popular option for the ultra-wealthy: 44% of respondents said they’re likely to use one for an upcoming trip (up from 40% last year). Doug Gollan, Founder of Private Jet Card Comparisons, notes that leisure demand for private jets continues to break records, driven by the unreliability of commercial flights and the perceived value by families in particular.

The Take: Tastes will evolve, but for now it would be wise to focus on the bottom of Maslow’s pyramid when it comes to the needs of luxury travelers: comfort, privacy, exclusivity, reassurance.

Taking the “Big Trips” — Together

Travelers are more interested than ever in taking once-in-a-lifetime journeys, and the poll data bears that out. Interest in safari/game reserve, overnight rail, and expedition cruise vacations has soared, with 21% of affluent luxury travelers planning them between now and the end of 2023, up 10 points since last year. The interest in expedition cruises — say, Antarctica and the Galápagos — drove an increase in cruises overall, with 55% likely to purchase a cruise on their next trip. That trend is certain to accelerate, with relaxing restrictions, should that movement continue. Demand for multigenerational trips is vigorous, with two-thirds of respondents planning one in the next 18 months. Moreover, one in five luxury travelers (20%) are planning multiple multi-gen trips, now and after December 2023.

The Take: Cruise lines can build on their success by positioning more sailings as “life list” worthy and luxury suppliers can also appeal to that “once-in-a-lifetime” drive. As multi-gen travel becomes a regular occurrence, companies must accommodate the services they require, such as multiple rooms and suites, outdoor activities, and private chefs.

Flexibility is Crucial

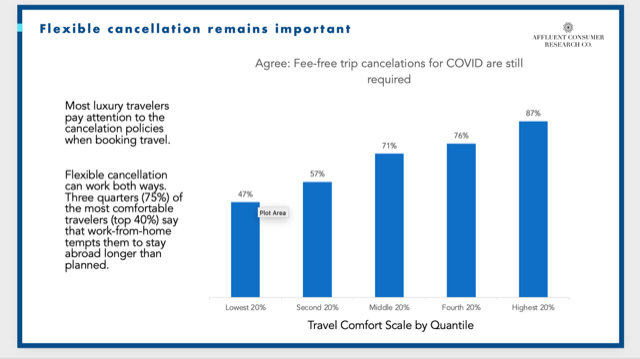

Most luxury travelers still pay attention to cancellation policies when booking trips, and a majority (69%) still want to see fee-free trip cancellations. Indeed, luxury travelers are likelier to insist on a flexible cancellation policy with concerns about upticks in COVID cases afoot and fears of getting sick and having to cancel. Moreover, the number of luxury travelers who say they’ve booked a “Plan B” trip in case the first is canceled has increased more than 50% since last year — to 65% from 43% — likely because of concerns about flight cancellations as well as changeable COVID protocols. That “trip stacking” trend has the potential to wreak havoc on inventory management.

The Take: Flexible, consumer-friendly cancellation policies are still a prerequisite for many luxury travelers. However, to dampen the impact of trip stacking, it may be necessary to modify terms and deposit requirements.

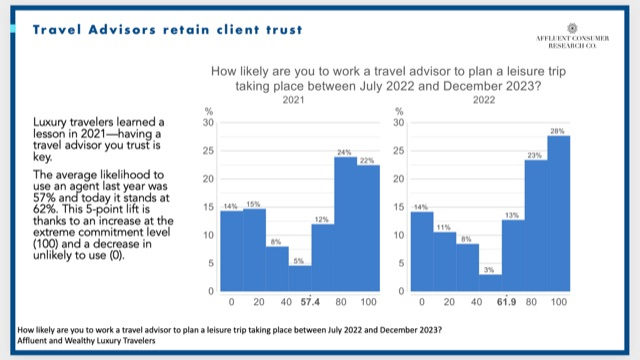

Travel Advisors More Essential than Ever

Luxury travelers learned a critical lesson last year: Having a travel advisor you trust is key to a successful trip. In 2021, 40% used a patchwork of advisors to make plans; this year, that number decreased to 22%, with a corresponding increase in those working with one specific advisor (43%). The survey also recorded a 5% lift in the likelihood of using an advisor in the next 18 months. Given the renewed focus on experiences, it’s not surprising more luxury travelers are coming to recognize the value of an advisor’s expertise.

The Take: Top advisors should have plenty of support due to increasing demands by luxury travelers and the chaos involved in traveling at this time.

The Young, Affluent Luxury Traveler

The younger (25-44) generation of affluent and luxury consumers has a more personal, values-based mindset than their older counterparts when it comes to decision making about travel plans. The younger generation are far more likely to say that the way they evaluate a luxury brand has changed since the pandemic (59% vs. 41%) and that they’re more willing to trust a luxury brand when they hear from its leadership (58% vs. 43%). Core attributes of a trip remain constant: “fun,” “memorable,” “beautiful setting,” and “high-quality materials.” But the 25-44 set were more likely to choose such traits as personalized experiences, corresponding brand values, tech forward; and adhering to sustainable practices.

The Take: Defining and communicating brand values in travel product remains critically important to attracting the millennial generation.

Author: Lark Gould

Lark Gould has been a travel industry journalist for more than 30 years. She shares her insight on cruise travel, air travel, hotels, resorts, popular activities, attractions and destinations to assist travel advisors and travelers with the current news and information they need to travel well.

Get Social